Conversion of Private company into Public Company..

In today’s business landscape, companies often need to adapt and transform to meet changing market demands and capitalize on growth opportunities. One such transformation is the Conversion of a Private Company into Public Company. The Companies Act, 2013 in India provides a legal framework for this conversion process, outlining the procedures, requirements, and implications involved. This article will delve into the details of Conversion of a Private Company to Public Company under the Companies Act, 2013.

Conversion of Private Company to Public Company as per Companies Act, 2013

The Companies Act, 2013, enacted by the Indian Parliament, provides a comprehensive legal framework for the functioning and regulation of companies in India. Among the various provisions outlined in the Act, one significant aspect is the process of conversions of private company into public company.

Converting a private company to a public company involves transforming the legal structure of the business to enable public trading of its shares on a recognized stock exchange. This transition brings various benefits such as increased access to capital, enhanced market presence, and improved credibility.

However, the conversion process requires meticulous compliance with legal and regulatory obligations, including drafting and filing necessary documents, obtaining approvals, and adhering to disclosure requirements.

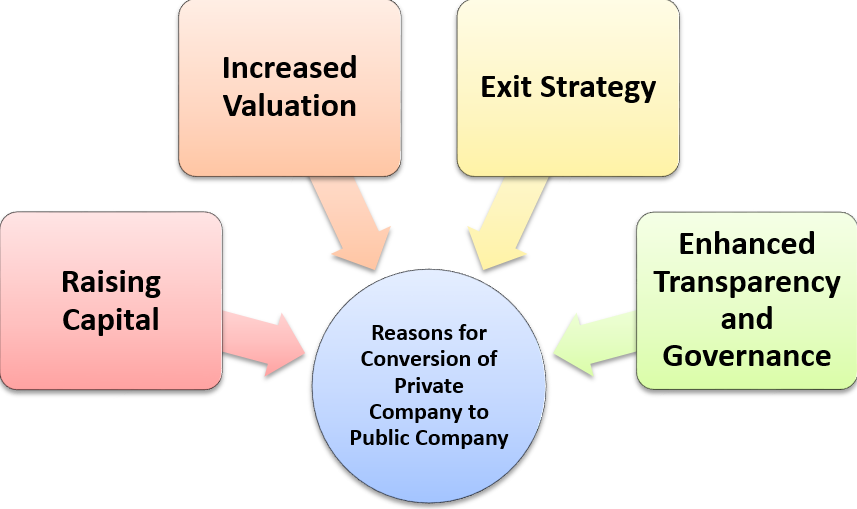

Reasons for Conversion of Private Company to Public Company

Private Companies often choose to convert to Public Companies for several reasons. Some of the common motivations behind such a conversion are:

- Raising Capital

Public Companies have the advantage of accessing a broader pool of investors and raising funds by issuing shares through Initial Public Offerings (IPOs). This influx of capital can be instrumental in expanding the business, funding new projects, or reducing debt.

- Increased Valuation

A Public Company’s valuation is often higher than that of a private company due to the wider market recognition and potential for liquidity. The conversion to a public company can enhance the overall value and attractiveness of the business.

- Exit Strategy

Converting to a Public Company can provide an exit route for existing shareholders, including founders and early investors, who may wish to monetize their investments and unlock value.

- Enhanced Transparency and Governance

Public Companies are subject to greater regulatory scrutiny and are required to comply with stricter corporate governance norms. This can instill investor confidence, attract institutional investors, and foster transparency in operations.

Benefits of Conversion of Private Company to Public Company

Some of the benefits of Conversion of Private Company to Public Company are as follows:

Access to Capital: One of the primary advantages of converting a private company to a public company is the ability to raise capital from the general public. By issuing shares to the public through an Initial Public Offering (IPO), a company can attract investments from a wider pool of investors, including institutional investors and retail investors. This infusion of capital can provide the necessary funds for expansion, research and development, acquisitions, and other strategic initiatives.

Enhanced Brand Visibility: Going public can significantly enhances a company’s brand visibility and reputation. Public companies are subject to increased scrutiny and disclosure requirements, which can help build trust among stakeholders, including customers, suppliers, and partners. The status of being a public company can instill confidence in the market, attract new customers, and provide a competitive edge.

Liquidity for Shareholders: Conversion to a public company can provide an exit strategy for existing shareholders. In a private company, the shares are often illiquid, making it challenging for shareholders to sell their stakes. However, by going public, shareholders can sell their shares on stock exchanges, providing liquidity and the ability to realize their investments. This increased liquidity can make the company’s shares more attractive to potential investors.

Expansion Opportunities: A public company enjoys better access to growth opportunities. With increased capital resources, a public company can undertake expansion plans, enter new markets, invest in research and development, and execute strategic acquisitions. The ability to tap into public markets allows for greater flexibility in pursuing growth strategies and achieving economies of scale.

Valuation and Exit Options: Public companies generally have a higher valuation compared to private companies. The market value of a public company’s shares is determined by market forces and investor sentiment. This can provide a benchmark for valuing the company and can be advantageous in scenarios such as mergers and acquisitions or raising further capital through follow-on offerings. Moreover, being a public company offers an exit option for the promoters and early investors who can gradually sell their shares in the market.

Employee Incentives: Conversion to a public company can open up opportunities for employee stock ownership plans (ESOPs). ESOPs allow employees to become shareholders and benefit from the company’s growth and success. This can be an effective tool for attracting and retaining top talent, as employees have the potential to share in the company’s financial success and align their interests with the long-term goals of the organization.

Regulatory Compliance and Governance: Public companies are subject to stricter regulatory requirements and corporate governance standards compared to private companies. This can lead to improved transparency, accountability, and investor protection. Compliance with these regulations enhances the company’s credibility and reduces the risk of corporate governance-related issues. Adopting robust governance practices can also attract institutional investors and strengthen the company’s reputation in the market.

What are the Key considerations for Conversion of Private Company to Public Company?

There are specific rules to be followed when the Conversion of Private Company to Public Company is done. The key points of consideration are as follows:

- The members of the Company should approve for the Conversion of Private Company to Public Company.

- Name clause in the Memorandum of Association (MoA) should be amended to exclude the word Private.

- The number of members of the Company is 7 before the Conversion of the Company as prescribed under Section 3(1) of the Companies Act, 2013.

- The number of the director to be increased to 3 as prescribed under Section 149(1) of Companies Act, 2013.

- The Company should file all the annual returns or financial statements due for filing with the Registrar of Companies (RoC).

- The Company should pay all the matured deposits as prescribed under Rule 29(1) of Companies (Incorporation) Rules, 2014.

- An application should be made to modify Permanent Account Number (PAN) of Company.

- Provide information to the Central government, where the Company is registered.

- Articles of Association (AoA) should be altered so that they no longer include the restrictions and limitations of a Private Limited Company.

- The Central Government should also approve the Conversion.

Documents required for Conversion of Private Limited to Public Limited Company as per Companies Act, 2013

The following documents are needed for conversion of private limited to public limited company:

- Shareholders’ PAN Card Details

- If the shareholder is a foreign national, a copy of the foreign national’s passport must be submitted.

- PAN, Aadhaar Card, Voter ID are the identification documents required for shareholders and directors.

- Electricity, water, and other utility bills

- NOC (No Objection Certificate) from the registered office owner

- Rental Agreement and other registered office documents

- If the person is a foreign national, all documents must be notarized by the appropriate government.

- The MOA and AOA

- A copy of the company’s Certificate of Incorporation with CIN( Certificate Incorporation Number)

- Company’s Income Tax Returns

- Company’s most recent Audited Financial Statements

- DSC (Digital Signature Certificate Online) and DIN ( Director Identification Number ) of two directors

Forms necessary for the conversion of Private Limited Company to Public Limited Company

For the conversion of a private limited company to a public limited company, the following forms are required:

- Form MGT 14: Form MGT 14 must be submitted to the Registrar of Companies. Along with this information, the ROC must receive the notice of the EGM, amended AOA, amended MOA, statements with explanations, and resolutions adopted at the EGM.

- Form INC 27: Form INC 27 must be submitted to the Registrar of Companies. Along with this information, the ROC must receive the notice of the EGM, amended AOA, amended MOA, statements with explanations, and resolutions adopted at the EGM. The minutes of the meeting must also be sent to the ROC.

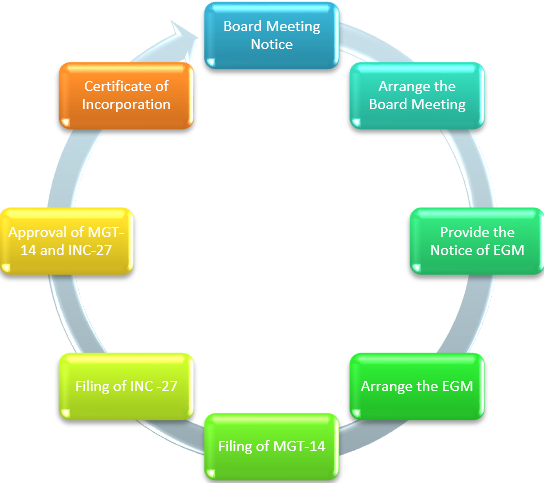

Procedure of Conversion of Private Limited to Public Limited Company

The following is the procedure for Conversion of Private Company to Public Company:

- Board Meeting Notice

To hold a board meeting, the Private Company’s directors must provide notice according to the provisions of section 173(3) of the Companies Act 2013. The meeting must be announced seven days in advance. This notice must include the meeting’s agenda.

The Board Meeting should be held to discuss the following agendas:

To adopt new Memorandum of Articles (MoA) subject to the approval of shareholders.

To adopt new Articles of Articles (AoA) subject to the approval of shareholders.

To get the approval of Conversion of Private Company to Public Company from the shareholder.

Fix date, time and the place for holding EGM in the Company.

To get approval for EGM and authorize someone to circulate notice of EGM.

After, the passing of the notice the next step is to hold a Board Meeting.

2. Arrange the Board Meeting

The next stage is for the company to have a board meeting. The following items must be authorized at the board meeting:

- Prepare a resolution for the conversion of a private limited company to a public limited company.

- Complete the company’s list of creditors.

- Approve the drafts of the Memorandum and Articles of Association.

- Consider setting a date and location for the EGM.

- Approve the notice of EGM with agenda and statement to be added to the notice of General Meeting , as per section 102(1) of the Companies Act 2013.

After, the arranging of Board Meeting the next step is to provide notice to hold EGM.

- Issue of EGM Notice According to the provisions of Section 101 of Companies Act, 2013, the issue of notice of EGM will be given to all the Directors, Members and Auditors of the Company.

The shareholder’s approval for the Conversion of Private Company to Public Company will be taken in the resolution passed by all the shareholders in the Extra-ordinary General Meeting (EGM). The notice of EGM should be given not less than 21 days before the date on which the EGM is to be held.

The notice period to shareholders can be shorter if the consent is given in writing or through an electronic medium by not less than 95% of the members entitled to vote at such meetings. Also, follow the procedure for prescribed for issuing and signing of notice of EGM.

The EGM will be held on the fixed date and resolution will be passed. The resolution will be passed for Conversion of Private Company to Public Company and alteration of MoA and AoA.

- Arrange the EGM

The company must then hold an EGM as the next stage. In this case, a special resolution [75%] requiring a majority vote must be considered to be carried. The approved MOA and AOA must also be considered by the meeting’s directors.

- Filing of MGT-14

- In case of modification in Article of Association for the conversion to a public company special resolution, it requires to be passed under section 14. According to section 117(3)(a), a copy of this special resolution is expected to be filed with the concerned ROC through the filing of form MGT.14 within 30 days of passing the resolution in the EGM.

- According to Rule 33 of Companies (Incorporation) Rules, 2014, File Form INC-27 within 15 days after passing of the resolution in the EGM.

- The following attachments should be attached with the INC-27:

- Minutes of the Meeting

- Copy of Altered MoA

- Copy of Altered AoA

- Copy of the Resolution passed

- List of members in the Company with all the essential details

- Optional Attachments if required.

- As per section 18, after receiving the documents for the conversion of a private limited company into a public limited company, ROC shall convince itself that the company complies with the necessary provisions for registering a company. If so convinced, ROC (Registrar of Companies) shall enclose the previous registration and issue a fresh certificate of incorporation, after registering the documents presented for change under the specific class of the company.

Post-Compliance Requirements for Conversion of Private Limited to Public Limited Company

Once the conversion is approved by the Registrar of Companies (ROC), the following post-compliance requirements must be met:

Alteration of Memorandum and Articles of Association

The company’s Memorandum and Articles of Association must be amended to reflect the change in the status from Private to Public. The alteration should be approved by the shareholders and filed with the ROC.

Increased Minimum Capital

A Public Limited Company must have a minimum paid-up share capital of INR 5 lakhs or such higher amount as prescribed. The company must ensure compliance with this requirement within a specified time frame.

Appointment of Independent Directors

A Public Limited Company must have a certain number of independent directors on its board, as mandated by the Act. The company must appoint independent directors within the stipulated timeframe and ensure compliance with their obligations.

Compliance with Listing Regulations

If the company intends to list its shares on a stock exchange, it must comply with the listing regulations of the respective exchange. This includes fulfilling disclosure requirements, corporate governance norms, and periodic reporting obligations.

Compliance with Public Company Reporting

A Public Limited Company must comply with additional reporting requirements compared to A Private Limited Company. This includes filing regular financial statements, holding annual general meetings, and maintaining statutory registers.

It is crucial for companies undergoing conversion to ensure compliance with all legal, regulatory, and procedural requirements. Engaging legal and financial professionals with expertise in corporate law can be beneficial to navigate the complexities associated with the conversion process.

The benefit of the following exemptions given to the Private Company will not be available to any public companies after conversion:

- Public Companies shall file form MGT-14 for all the resolutions passed under Sections 117 & 179 (3).

- For acceptance of deposits from members private company not required to comply with the conditions of clause (a)-(e) of Section 73(2). But in the case of a Public Company, it is required to comply with the conditions of clause (a)-(e) of Section 73(2).

- Public Companies can’t accept deposits from the relative of directors unless they comply with the provision of Section 73.

- Provisions of Sections 101 to 107 will be applicable.

- Provisions of Section 109 will also be applicable to Deemed Public Company.

- Provisions of Section 43 (Kinds of Share Capital) & 47 (voting rights- in case of pref. shareholders did not pay a dividend for two years) will also be applicable.

- Exemption under Section 67 relating to Restrictions on Purchase by the Company or Giving of Loans by it for Purchase of its Shares will not be available. Provisions of Section 160 (Right of Persons Other than Retiring Directors to Stand for Directorship) will be applicable.

- Internal Financial Controls will become applicable to Public Company.

- Provisions of Directors liable to retire by rotation will be applicable.

- Provisions of Section 180 with respect to Restrictions on Powers of Board to sell, lease or otherwise dispose of the whole or substantially the whole of the undertaking of the company and to borrow money, where the money to be borrowed, together with the money already borrowed by the company will exceed aggregate of its paid-up share capital, free reserves and securities premium apart from temporary loans obtained from the company’s bankers in the ordinary course of business Exemptions under Section 185 relating to Loans to Directors and any other person in whom the Director is interested, will not be applicable. This exemption is not available to public companies.

- A Loan can be given to a public company if the Director has a shareholding at 25% whether individually or together.

- Exemption under Section 188 (1) (Related Party Transactions) will not be available.

- In the case of ESOP, All Public companies will required to pass a Special Resolution.

- Exemptions relating to Internal Financial Controls will not be available. Section 143 (3)(i).

- Disclosure of Interest and Participation Section 184: In a private company, an interested director can participate in the meeting after disclosure of interest. However, in a public company, such participation is not permitted.

- Provisions of Section 197 with respect to Managerial Remuneration will become applicable.

- Provisions of the following sections which are exempted to Private Companies will become applicable to Public Companies:

- Section 101: Notice of Meeting Section

- 102: Explanatory Statement Section

- 103: Quorum of the General Meeting Section

- 104: Chairman of the General Meeting Section

- 105: Proxies Section

- 106: Restrictions of Voting Rights Section

- 107: Voting by show of hands Section

- 109: Demand of Poll.

For Students Note taking point of view: -

Step 1

The company must conduct a Board Meeting to pass Board Resolution for the approval of Notice of General Meeting, Conversion and for the alteration of MOA and AOA.

Step 2

It should conduct General Meeting and pass Special Resolution(SR) for the Conversion, Alteration in MOA and AOA and for the name change of company (delete word “Private”) and to alter the three restrictions in articles of pvt. Companies.

Step 3

File an E-Form MGT-14 within 30 days from the passing of Special Resolution with following attachments:

1. Notice of General Meeting along with copy of Special Resolution

2. Altered MOA

3. Altered AOA (Note: As per section 117 (1) of the Companies Act, 2013 copy of every resolution which has the effect of altering the articles shall be embodied in or annexed to every copy of the articles issued after passing of the resolution)

Step 4

File an E-Form INC-27 for conversion of Private to Public Company within 15 days from passing of Special Resolution with following attachments:

1. Notice of General Meeting along with copy of Special Resolution

2. Altered MOA

3. Altered AOA

4. Details of Director Promoter and Subscribers

5. Minutes of the General Meeting

After the approval of both the above forms the CIN number of Company will be changed by substituting word “PTC” to “PLC”.

Post Conversion Requirements:

1. A Fresh PAN card has to be applied for

Other Registration details shall be updated/changed accordingly such as TAN, GST, PT, PF, ESIC, etc.

Name of Company and its Status shall be updated in all other regulatory authorities & Banks etc. .

2. All Business letterheads and related stationery should be updated with the company’s new name

3. The bank account details of the company to be updated

4. Intimation to concerned authorities to be given

5. Printing of copies of New MOA and AOA

Changes shall be noted in every copy of MOA & AOA otherwise fine of ₹1000 per copy shall apply.(Section-15).

Author Bio : GYANA RANJAN PANDA

Keep it up and continue to post like this type of contents

ReplyDelete